Validating your payment methods

As part of our license requirements, we need to make sure you're the owner of any deposit and withdrawal methods you intend to use with us.

This validation is a one-time-only need for each new payment account you intend to use. Once we verify a payment account, we won't need to verify it again.

All the documents we receive are safely held. We won't use them for any other purpose than verifying your payment methods.

When do I need to verify my payment account?

We'll ask you for proof of ownership in these two situations:

- Before making your first deposit with a new and unverified payment method

- Before making a withdrawal with a new and unverified payment method

Before you can make a withdrawal, we also need a copy of your ID. If you've already sent one and it's still valid, you don’t need to send it again.

Once you verify a payment method you won’t need to send any extra documents for that purpose.

How do I verify my payment account?

Whenever you head to the Cashier to make a deposit or a withdraw with a new and unverified payment account, we'll prompt you to send a proof of ownership for that account. All you need to do is follow the instructions on-screen, upload your documents, and we'll take care of the rest!

You can upload your documents via our desktop software, mobile app, or website.

Which documents do I need to send?

To know which documents you'll need to send, choose your payment method from the list below.

Apple Pay

- A screenshot of your Apple Wallet app, showing the card you'll use for your transactions and showing one deposit made to us. Alternatively, a photo of the front of the card you use with your Apple Pay.

- For virtual cards, a screenshot - showing only the first 6 and last 4 digits of that card - showing your name, the date of issue, and the expiry date of the virtual card.

Cards (Visa, Mastercard)

- A copy of your card statement (no older than 3 months) showing the cardholder name, and only the first 6 and last 4 digits of your card number. There's no need to include your transaction history. If your card statement displays your full card number, please blank the middle digits out before sending to us.

- Alternatively, we'll accept a scanned copy of your card - only displaying the first 6 and last 4 digits of the card number.

Trustly, Direct Bank Transfer & Wire Transfer

- A screenshot of the summary page of your online banking service. It needs to show your full name and the account details. The URL must be visible. There's no need to include your transaction history.

- Alternatively, a copy of a bank statement showing your name, IBAN, and Swift/BIC code of your bank account (no older than 3 months).

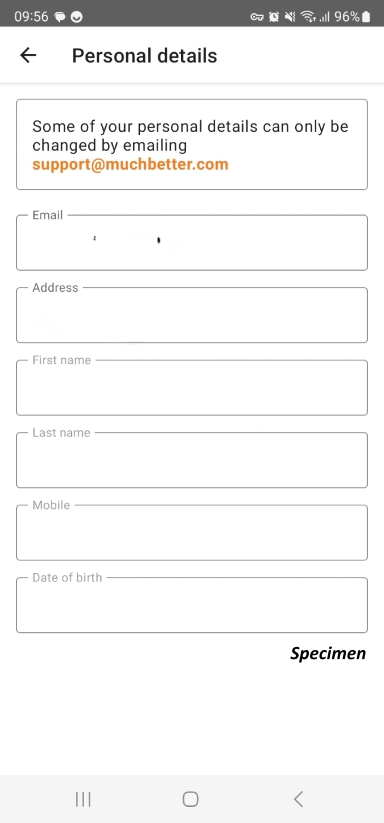

MuchBetter

- A screenshot of your 'Personal Details' section within the 'Profile' menu showing your Name, Date of birth, Address, Email&Phone number.

-

If you're using a Mastercard issued by MuchBetter, we will also need a copy of that Mastercard (only displaying the first 6 and last 4 digits of your card number (e.g., 444444******4444).

NETELLER

- A screenshot of the whole page of the 'Account Overview' section of your NETELLER account, when logged in. The URL must be visible.

- The screenshot needs to display your name and the registered email address of your NETELLER account. You can click on the top-right hand corner on the 'Account Overview' page to expand this information.

Skrill

- A screenshot of the whole page of the 'Personal info' page, when logged into your account. The URL of the page must be visible.

- The screenshot must display your name and the email you've registered to your Skrill account.

- There's no need to include your transaction history

WebMoney

- A screenshot showing the whole page of the ‘My Account’ section. The URL of the page must be visible.

- The screenshot must show the personal details of your WebMoney account.

- There is no need to include your transaction history

Protecting your payment data

If the document you're sending shows the full card or account number, edit the image and mask that information before sending it to us. Otherwise, we won't be able to process your document for compliance reasons.

For example:

- For card numbers, replace all characters except the first 6 and the last 4 with asterisks (e.g., 444444******4444)

- For all other account numbers, replace all characters except the first 1 and last 4 with asterisks (e.g.,7*****7777)

- For IBANs, replace all characters except the first two letters and last 4 numbers with asterisks (e.g., XX******************1234)

Did you find this article useful?

Related Articles

- Deposits and Withdrawals: Available payment methods

- What are Chests and how do they work?

- Self-exclusion: information and instructions

- Connection issues: Try Google DNS

- Progress Bar explanation

- Deposits: Deposit limits feature

- Changing your account currency

- GDPR and personal information safety

- Rake in Play Money games

- Deposit and withdraw using Apple Pay